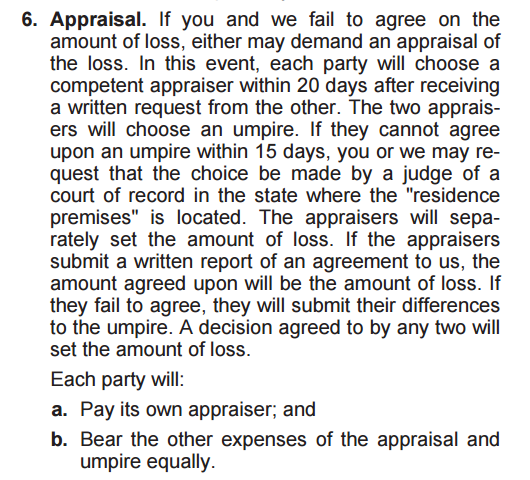

Many Florida homeowners insurance policies contain a specific clause called appraisal which can have a huge impact on the outcome of your homeowners insurance claim. Most homeowners have no idea that an appraisal clause exists in their insurance policy and find out for the first time when their insurance company demands appraisal of their homeowner’s insurance claim. To get an idea of what you are looking for, a typical appraisal clause looks similar to this:

These appraisal clauses are nearly identical between most Florida homeowners insurance policies and can be used by either the homeowner or insurance company to determine the total amount of damage to the home. However, before a claim can be submitted to appraisal, the homeowner and insurance company must have a disagreement regarding the dollar amount of damage to the home. For example, if the insurance company decides that a plumbing leak has caused $5,000 of damage to your home but your contractor gives you an estimate of $20,000 to make repairs, the insurance company is entitled to demand appraisal to determine what the insurance company is obligated to pay you for your damages. Ultimately, this may result in you receiving less than the $20,000 it will cost you to make repair the damage.

The appraisal process requires that the homeowner and insurance company each select their own appraiser to represent them. The appraisers will then try to come to a mutual agreement as to the damages to the home. If they are able to agree, the final number will fall somewhere between the damages determined by your or your contractor and those determined by the insurance company. If the appraisers cannot reach an agreement, the appraisers are required to select a neutral umpire who will then make the final determination as to the amount of damages. The number arrived at via appraisal is FINAL and outside of very specific circumstances, cannot be challenged or circumvented.

Even in light of the nature of appraisal, is not necessarily a bad thing. Given the right circumstances, appraisal can be a benefit to the policyholder. In other circumstances, where appraisal may not be preferred, certain actions can be taken to avoid appraisal. If you have any questions about appraisal or about your claim in general, please don’t hesitate to contact us.